Content

Market liquidity describes how easily a cryptocurrency can be bought or sold in the market without causing drastic price changes. High market liquidity means a large number of buyers and sellers, which translates into smoother trading and more stable prices. Liquidity in cryptocurrency refers to how quickly and easily an asset can be bought or sold without causing a significant change in its price. High liquidity means there are enough buyers and sellers in the market and trades can be executed smoothly at stable prices. Low liquidity, on the other hand, can lead to larger price swings crypto exchange liquidity solution when trades occur.

The Future Landscape: Liquidity in a Maturing Market

This means that the increased attention from the buyers can cause swift price spikes, but the spontaneous decrease in demand can cause significant economic downturns. The worst part is that nothing can effectively negate the massive price variations on the market, as the value of cryptocurrencies is highly dependent on public perception. However, its importance varies from industry to industry, as some sectors are more liquid than others. For example, the forex market around popular and established currencies seldom experiences dramatic liquidity problems. The safest crypto exchange is one that prioritises Financial cryptography security measures and has a strong reputation within the industry. There is no single “best” crypto liquidity provider, as different providers may excel in different areas depending on your specific needs.

Crypto Market Waver as Global M2 Stagnates—Can Stablecoins Save the Day?

Almost any industry will experience effortless and organic growth with these three metrics hitting higher levels. The inception and development of globalised financial markets have completely transformed the balancing game of the economy. Numerous new variables are vital in keeping the global economy flowing smoothly and ensuring healthy growth. One such https://www.xcritical.com/ critical concept is liquidity, which has become increasingly crucial with the uprising of international commerce.

Introduction to Liquidity in Crypto Markets

- When there’s a liquid market, even substantial transactions have a minimal effect on prices, minimizing price manipulation and promoting fair market conditions.

- Liquidity makes charging a discounted or a premium price impossible in a perfectly competitive market, since active cryptocurrency trading allows to avoid price distortions.

- Institutional investors and active traders seek out environments where market prices accurately reflect supply and demand dynamics, and they are more likely to participate in a stable market.

- Thus, lower liquidity causes an adverse chain reaction, where everything gets exponentially worse with time.

Institutional investors and active traders seek out environments where market prices accurately reflect supply and demand dynamics, and they are more likely to participate in a stable market. More traders are drawn to exchanges with a large selection of trading pairs, which can improve liquidity. Because they consistently place buy and sell orders, market makers are essential to the supply of liquidity because they guarantee that there is always a counterparty for transactions.

Before making financial investment decisions, do consult your financial advisor. It’s considered to be highly liquid due to its lengthy process of buying and selling land or buildings. These processes are generally full of paperwork and have a variety of eligibility requirements, among other things.

Conversely, if a digital asset’s market is illiquid, investors and speculators are likely to encounter a wider bid-ask spread, which increases the cost of transactions for that asset. Liquidity in the crypto sphere means the ease and speed with which a digital asset can be converted into other digital assets or cash without dramatically impacting its price. Unique to decentralized finance (DeFi) protocols, it consists of user-contributed liquidity pools facilitating decentralized trading, borrowing and lending. It indicates the depth and volume of a cryptocurrency’s market by reflecting how simple it is to buy or sell a particular coin across several exchanges. Exchange liquidity is the availability of buy and sell orders for different trading pairs on a specific cryptocurrency exchange. People view more dependable and trustworthy exchanges as having a high level of liquidity.

This is an unmistakable signal that the industry must change its outlook and strive to utilise groundbreaking blockchain technology with more practicality in mind. Otherwise, liquidity problems will persist in the future, causing more recessions and an eventual collapse of the entire market. Due to the scope of downturns and the dishonest behaviour that has populated the market for years, it will be a long and challenging journey to reclaim the initial popularity of crypto. However, this change is essential for the industry, as liquidity levels desperately require new market entrants to increase the trading volumes and the general turnover. As outlined above, liquidity levels determine financial and business market activity and health. Almost every industry-leading company has put up their shares on stock exchange platforms.

Trading volumes for Bitcoin are now comfortably in the tens of billions on a daily basis and have grown substantially since 2014. This is not to say that the bellwether currency has never experienced bouts of illiquidity. Once BTC prices crashed in 2018, volumes plummeted to around $5 billion per day. As the crypto market matures, the expectation is that liquidity will stabilize, reducing the chances of market manipulations and ensuring smoother trading experiences. Liquidity is a critical concept in crypto, even more important than other conventional industries. This metric can single-handedly decide the success or failure of the crypto market in the long-term future.

For example, in the United States, brokers are required to fill customer orders at a price equal to or better than the best available price among various trading venues. In a market with high liquidity, it’s easy for buyers and sellers to find one another and agree on prices based on market rates. As such, there’s little work involved in closing transactions, broker fees are competitive, and there are tight spreads – the difference in bid and ask prices between sellers and buyers. Moreover, liquidity is convenient when evaluating the speed and price slippage of exchanges that enable trades between fiat and crypto. Usually, liquidity levels are influenced by the number of users on the exchange platform.

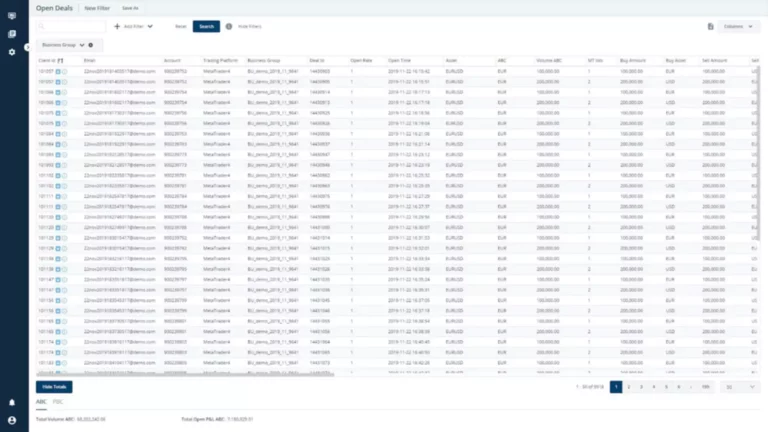

Exchange liquidity applies to the availability of liquid markets on a specific exchange. An exchange with high liquidity will have tight spreads between buy and sell prices, more frequent trading, and a large number of participants. In contrast, an exchange with low liquidity may have large price gaps between buyers and sellers, slower trade execution, and fewer participants, leading to greater price volatility. Asset liquidity refers to how easily a specific cryptocurrency or token can be converted into cash or another cryptocurrency. Cryptocurrencies like Bitcoin and Ethereum generally have high liquidity because they are widely traded across many exchanges. In contrast, newer or lesser-known digital assets may have lower liquidity, making it harder to sell them quickly without affecting their price.

They facilitate the maintenance of high liquidity levels, enabling traders to execute sizable orders with little fluctuations in price. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation. Many decentralised cryptocurrency exchanges like Crypto.com use Automated Market Makers (AMMs) to manage liquidity on the exchange.

More activity means a more consistent flow of support, which increases liquidity as buy and sell orders increase. Another important factor is market depth, represented by the spread of orders at different price levels. Several variables influence how easily assets can be traded on cryptocurrency platforms. A highly liquid crypto exchange means many people buy and sell various digital currencies, resulting in smooth trading with minimal price fluctuations. Now, the trading market features half of the previous players, which has caused wider spreads, less turnover and volume of trades.

We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. This increased engagement boosts market stability and confidence, attracting various investors. It also supports the foundation upon which the entire cryptocurrency ecosystem thrives. Combining cryptocurrencies with stablecoins or fiat currencies attracts traditional investors, increasing liquidity.

In times of crisis, central banks frequently step in to preserve market liquidity and avert financial disruptions. Maintaining investor confidence, keeping market efficiency and promoting the robust operation of economic ecosystems all depend heavily on liquidity. The liquidity of an asset exists on a spectrum with more liquid assets being easier and more efficient to convert into cash than less liquid assets. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. BitDegree.org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency.